This is where Spike comes in…

Spike is a financial solutions marketplace between companies and suppliers to execute advance payment on credit card receivables with more freedom, ease, and at a lower cost. With this tool, companies that make sales using credit cards can easily connect with multiple financial agents, thereby simplifying the negotiation and anticipation of receivables. This translates to reduced fees and greater flexibility in making decisions that benefit entrepreneurs' businesses, without being tied down by onerous contracts or excessive fees, as is currently the case.

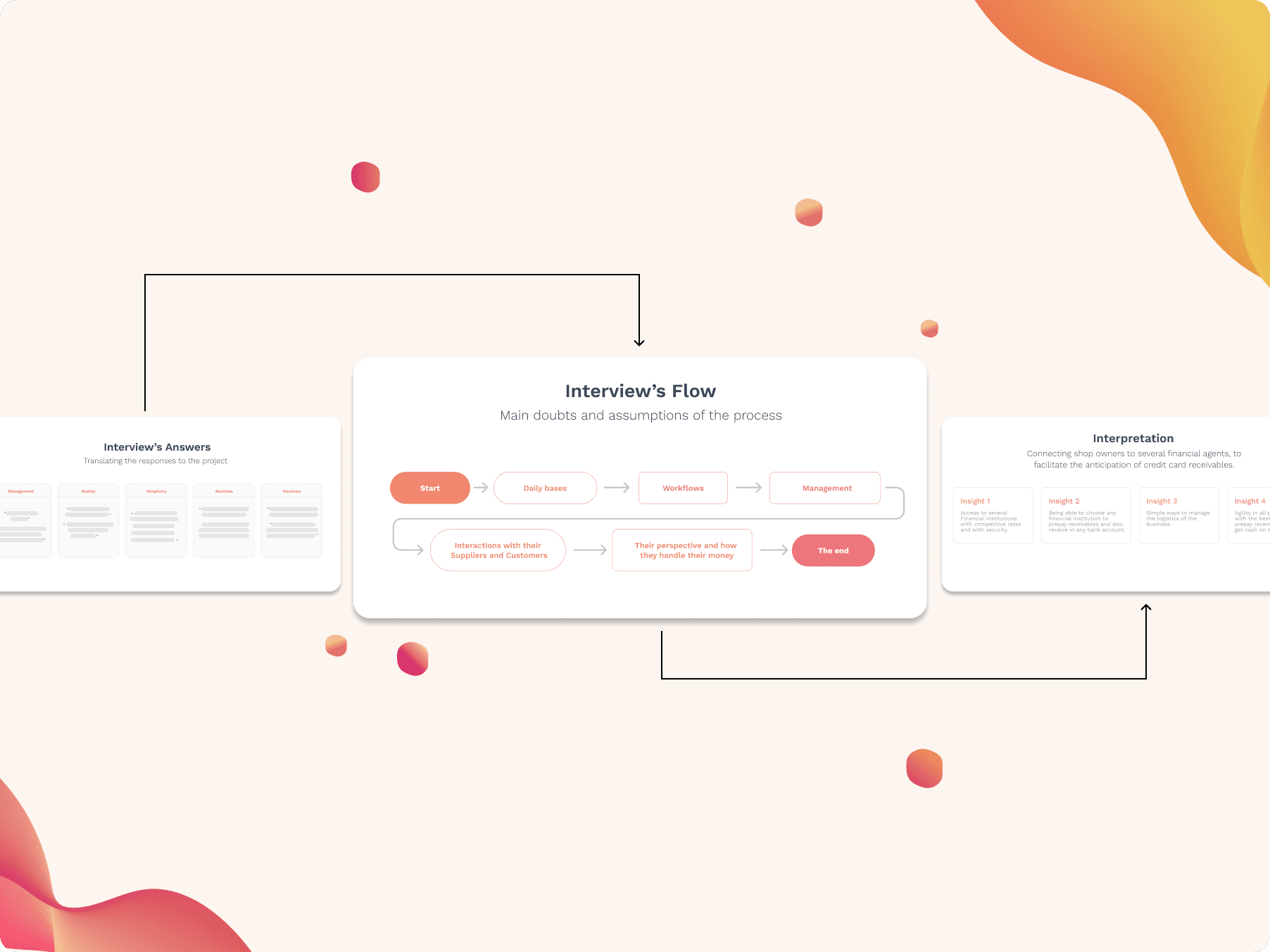

Discovery Process & User Interviews

Spike was already an idea when I joined Monkey Exchange because small businesses were not being reached in this way. As a design team our job was to work gathering insights on user needs, market trends, and challenges through research and analysis. This phase helped us to validate ideas and create a clear roadmap for product development. With all of these insights and having our assumptions validated we were able to structure conversations with users to understand their real needs.

If you click on the button below, you will see the story behind my design process. I'll guide you through the steps I took during user interviews and demonstrate how I used the insights gained and the feedback from users to shape and deliver the UI layouts.

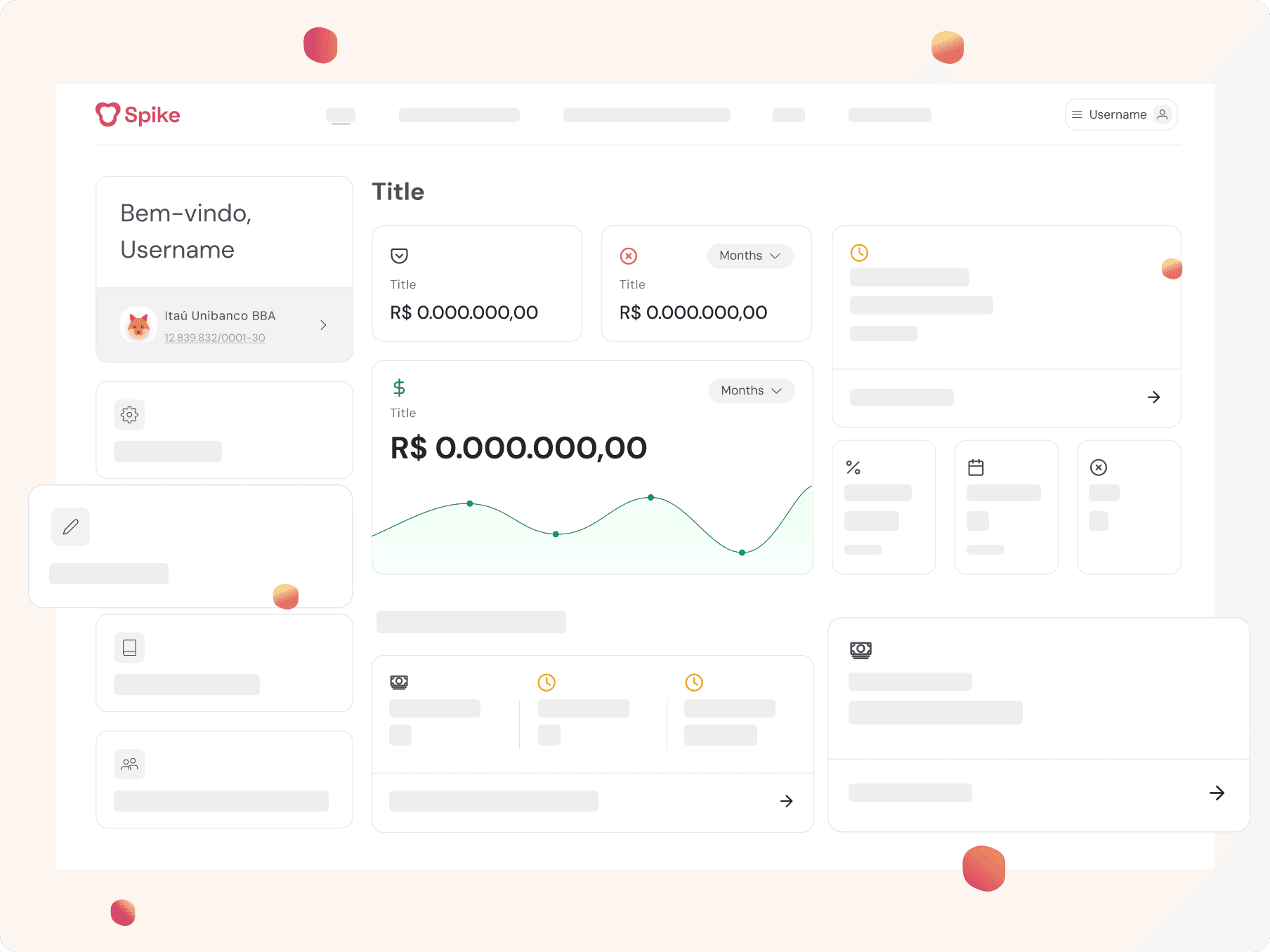

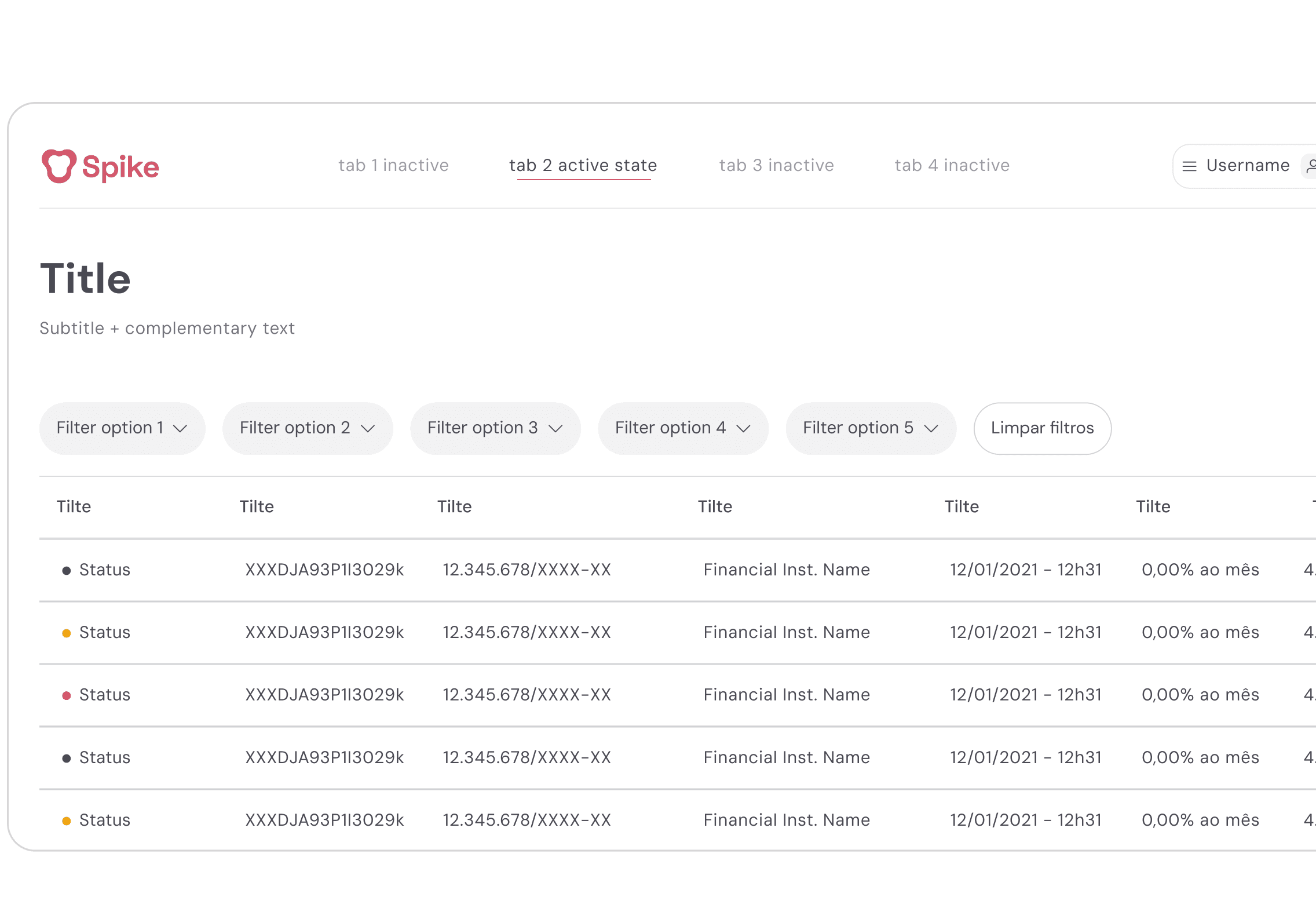

List View enhancement

Centralizing all receivables anticipation history in one place has made it easier to manage trade offers.

Fee Data Report

Keeping records of receivables for businesses allowing them to keep track of historical data.

Visual feedback

The ability to track the status of all receivable requests by providing live progress updates.

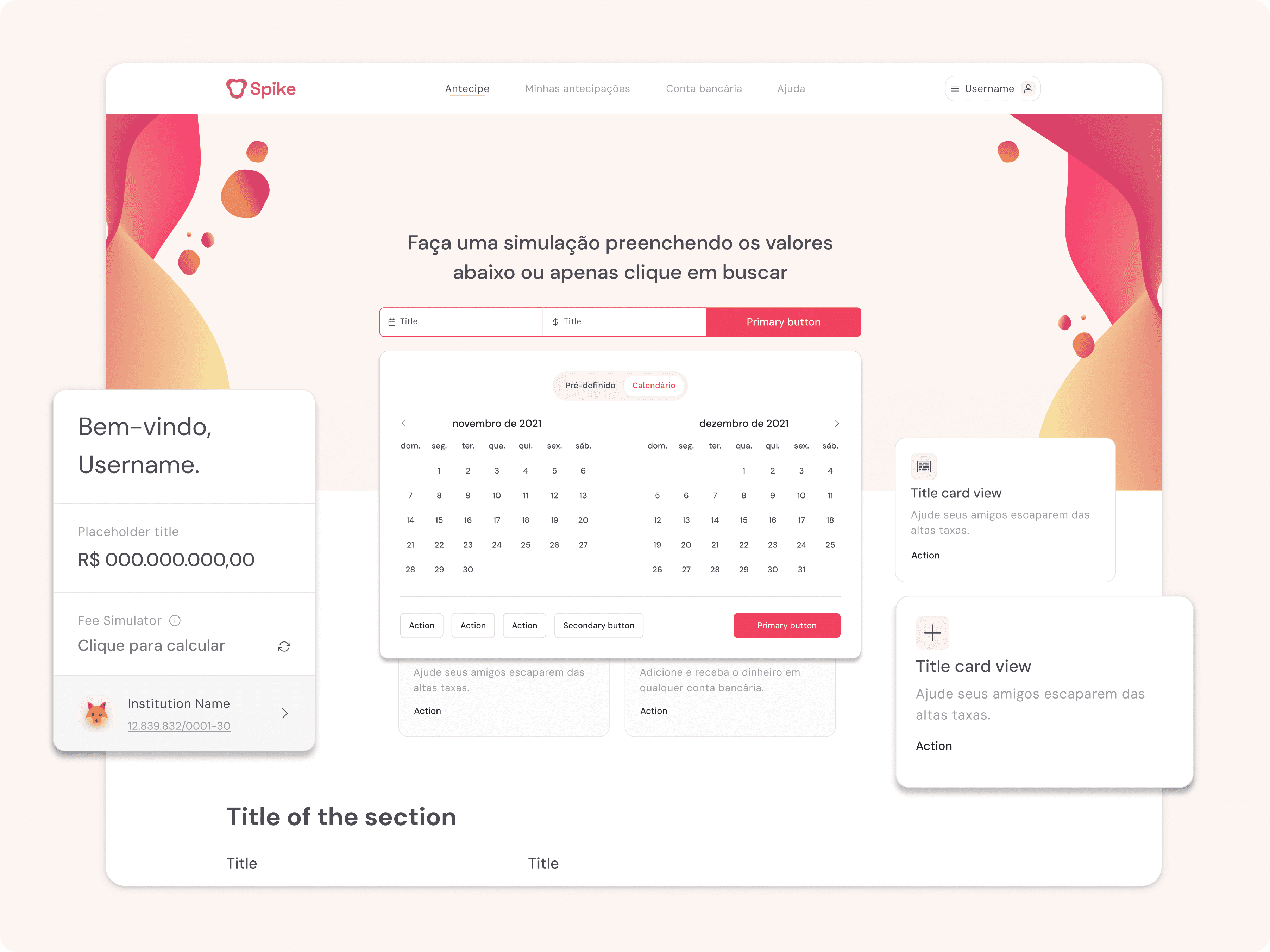

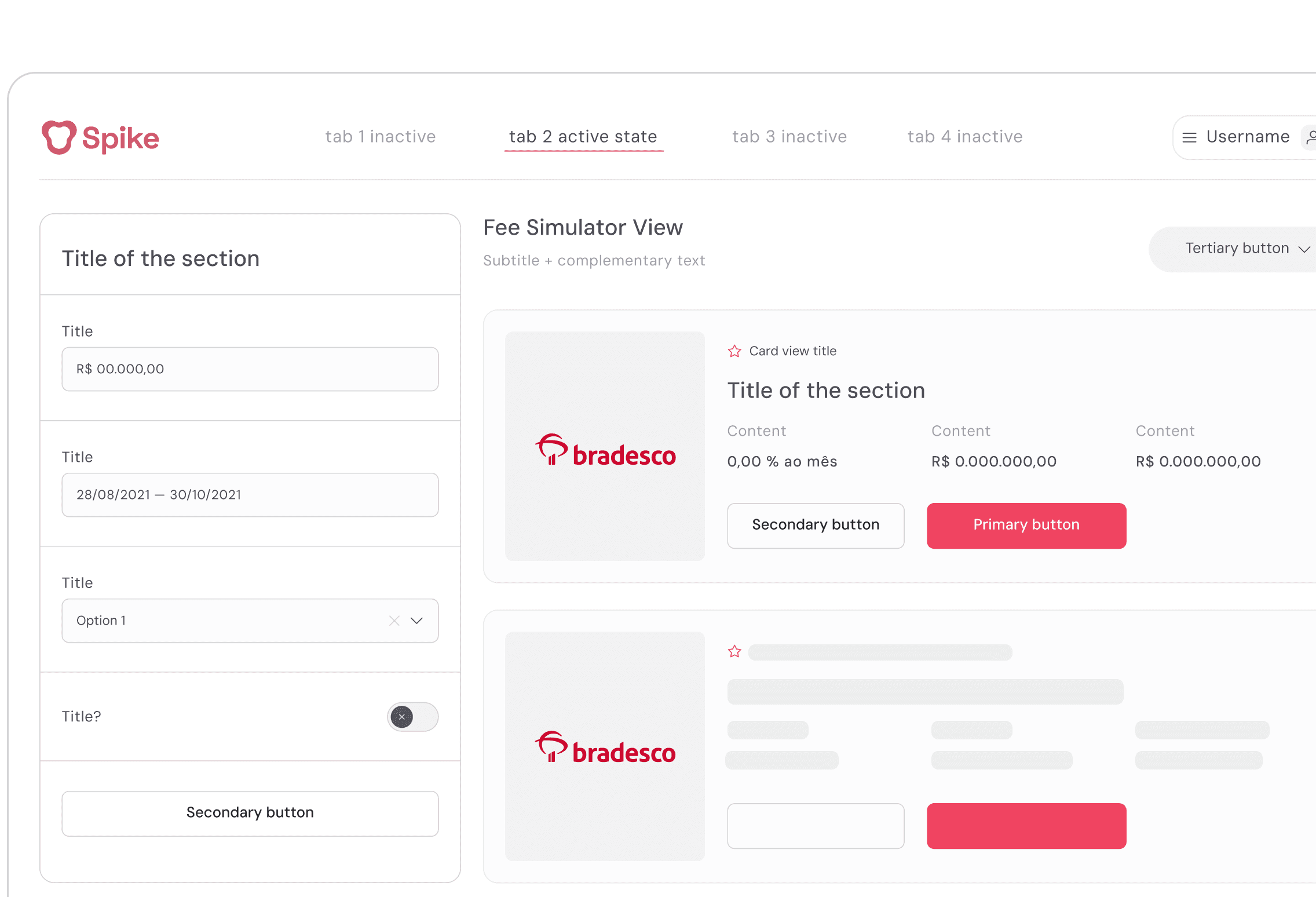

Fee Simulator

Giving an estimate and forecasting what is available to trade so businesses can anticipate an outcome.

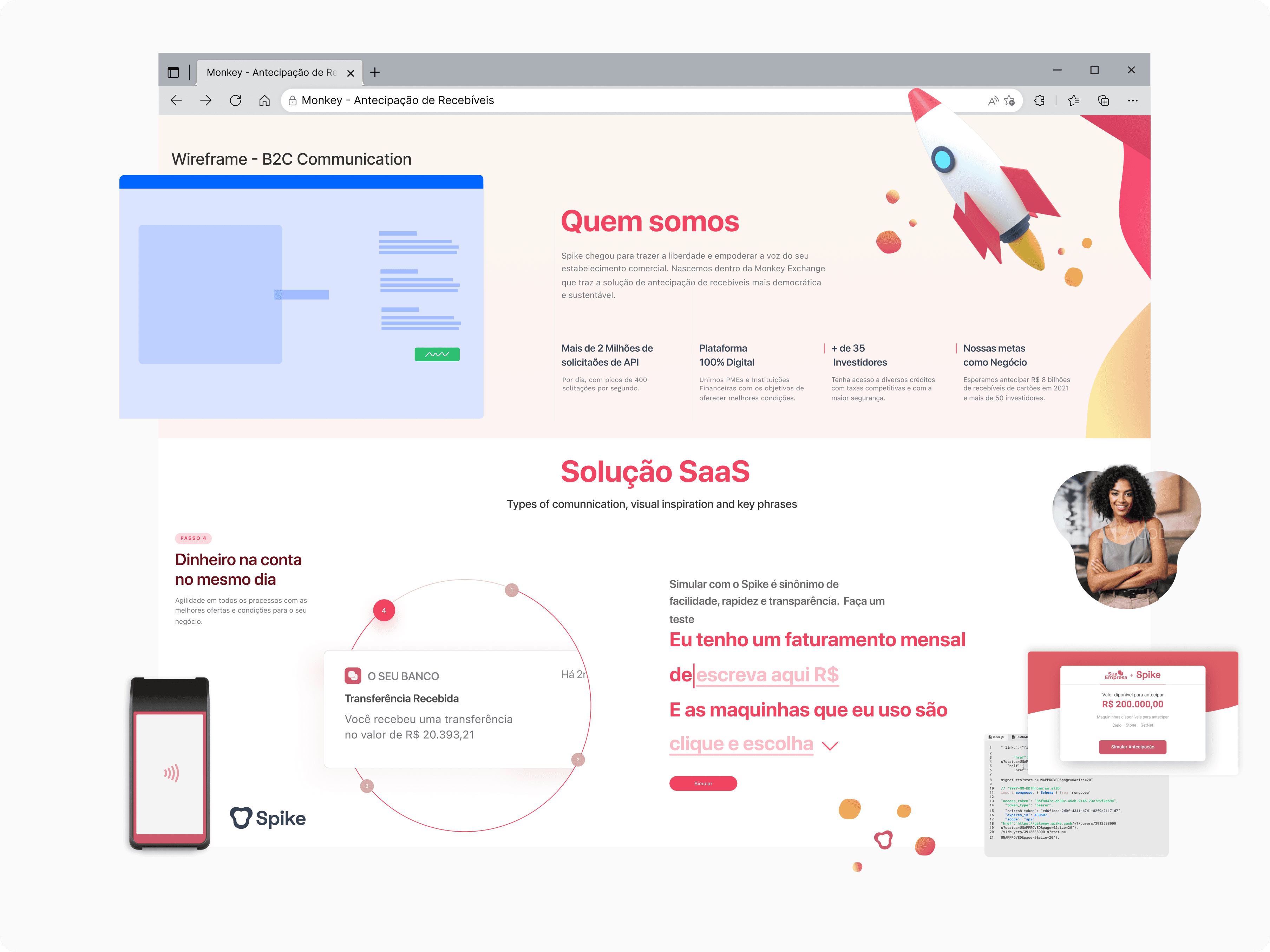

Landing Page (CMS)

A content management system created to advertise the benefits of the SPIKE SAAs platform.

Filters

Enhancement of the search component to make a customizable and personal user experience.

Impact & Reflections

Spike was the main project I worked on at Monkey - a South American-based start-up that opened my eyes to the financial world and just how empowering it can be to work among a close-knit team.

While I did not get to fully see this project launch before leaving the company (due my move to the US) we did however have over two thousand API requests in the first week after the product’s soft launch. Our expectation that was surpassed at launching was 1.6 billion USD of card receivables in 2021 and more than 50 investors.

Many businesses in Brazil are currently benefiting from this project and I am glad I got to be a part of it and value this as my most impactful job yet.